TPL will be having it’s 1Q23 earnings release conference call on June 14th, 10:00 am ET. Please register on the following ![]() link

link

At an extraordinary general meeting held on November 30, 2020, TPL’s shareholders passed a resolution approving the redomiciliation of TPL from the Cayman Islands to Spain. As a result of the redomiciliation, TPL has converted from a company limited by shares under the laws of the Cayman Islands into a public limited company (sociedad anónima) under the laws of Spain. The redomiciliation of TPL to Spain became effective on January 27, 2021, when TPL was registered as a Spanish company in the Commercial Registry of Madrid and de-registered as a Cayman company from the Registrar of Companies.

TermoCandelaria Power Limited (or “TPL), a Colombian electric power generation company located on the Atlantic Coast, which owns and operates the largest portfolio of thermal power plants in Colombia through its subsidiaries, Termobarranquilla S.A. E.S.P. and Termocandelaria S.C.A. E.S.P. On January 9th,2020, TPL successfully priced US $186 million in a reopening of its 7.875% notes due 2029 with expected ratings of BB (S&P) /BB+(Fitch).

TPL will use the proceeds from the transactions to convert its TECAN power plant located in Cartagena, from a Bryton-cycle power plant to a combined cycle power plant, increasing the installed capacity of the plant to 566 MW. TPL’s TECAN power plant expansion will increase power to Colombia’s Caribbean coast and contribute to the economic growth and development of the region.

We are the fourth largest electric power generation company in Colombia, as measured by OEFs, and the fourth largest electric power generation company in Colombia, as measured by installed capacity as of December 2021. For the year ended December 31, 2021, our net revenues and Adjusted EBITDA were U.S.$574 million and U.S.$138 million respectively, while for the year ended December 31, 2020, our net revenues and Adjusted EBITDA were U.S.$564 million and U.S.$99 million, respectively.

We own and operate the largest portfolio of thermal power plants in Colombia, through our subsidiaries, Termocandelaria S.C.A. E.S.P., or TECAN, and Termobarranquilla S.A. E.S.P., or TEBSA, which have an aggregate total audited installed capacity of 1,283 MW. According to XM, Colombia’s power system had an installed capacity equal to 17,480 MW, as of December 31, 2021. Therefore, TPL’s installed capacity represented approximately 7.0% of the installed capacity in the SIN and 4.7% of national electricity demand

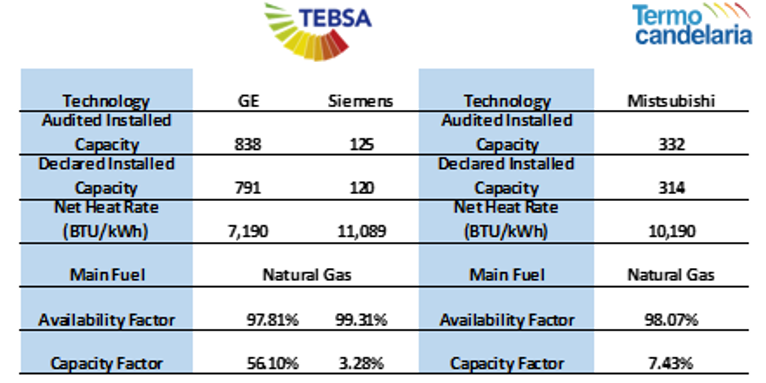

Set forth below is a table summarizing certain key operating metrics of each of our thermal power plants.

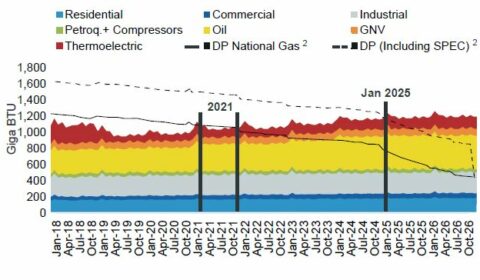

On October 29, 2014, TEBSA and TECAN entered into a terminal use agreement, or TUA, with Sociedad Portuaria el Cayao S.A. E.S.P., or SPEC, the only LNG regasification facility in Colombia, thereby securing access up to 72% (48.4% TEBSA and 23.5% TECAN) of the gross 170,000 m3 of storage capacity (equivalent to 400 MMscf/d of regasification capacity) of the facility, for a period of ten years ending on November 30, 2026, with the right to further extend for any period agreed by the parties. If there is no agreement between the parties and if TEBSA and TECAN have not provided notice to extend the contract four years in advance, the extension will be for five years until 2031.

The TEBSA Power Plant

TEBSA is the largest and one of the most efficient thermal power plants in the NIS. The plant consists of nine generation units, including five Alstom/GE gas turbines and two Alstom/GE steam turbines arranged in two interconnected combined-cycle blocks. In addition, the plant has two Siemens KWU (KRAFTWERK UNION) conventional steam turbines. As of the date of this offering memorandum, the aggregate installed capacity of the plant is 959 MW.

The TECAN Power Plant

TECAN is an OCGT, power generation plant consisting of two Westinghouse 501FC gas turbine units. The plant began operating in 2000 and in 2007 converted the turbine’s fuel system from natural gas only to a dual-fuel, with diesel or fuel oil #2 as alternative fuel.

TECAN is developing an expansion project through the conversion of its power plant from OCGT to a CCGT, which will increase its installed capacity by 252 MW, from 324 MW to 566 MW, which includes an enhancement of efficiency of close to 35%. This installed capacity increase will represent an expansion of approximately 19.8% of our total installed capacity and will allow TECAN to receive incremental OEFs through additional Reliability Charge revenues that were assigned through the auction that took place on February 28, 2019. As a CCGT, TECAN will become more efficient by reducing its heat rate to approximately 6,618 BTU/KWh, representing an efficiency enhancement of 35% (from 10,219 BTU/KWh under its current OCGT configuration).

Overview

- Solid regulatory framework with transparent rules that foster investment.

- Supportive industry dynamics favoring efficient thermal generators.

- Strategically located, highly efficient assets supporting the stability and growth of the national grid.

- Diversified revenue profile supported by U.S. dollar-denominated Reliability Charge and Regulated Revenue payments and upsides from out-of-merit and in-merit generation.

- Sound credit profile with conservative leverage metrics.

- Room for additional growth and competitive enhancements.

- Deep industry knowledge and regulatory experience.

Our strategy is based on the following key objectives:

- Maintain the sound operation of our power plants with stable and predictable cash flows.

- Expand installed generation capacity and increase plant efficiencies through expansion of TEBSA’s current CCGT and conversion of TECAN’s OCGT to CCGT.

- Deepen our market leadership in Colombia by expanding our generation capacity to satisfy increasing electricity demand.

- Provide high quality service while operating our plants efficiently, safely and sustainably.

The location of our plants in Colombia’s Atlantic region and our permanent access to LNG at competitive prices are distinct competitive advantages that differentiate us from other generators in the country and make our operations key to the stability of the national grid.

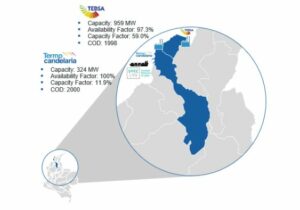

The map below shows the locations of our power plants as well as SPEC’s location:

Critical asset in Colombia and the Atlantic coast

-

- According to UPME, Colombia’s domestic natural gas resources are estimated to meet demand until 2021. The SPEC LNG regasification facility on the Atlantic Coast ensures long-term supply from global markets3.

- TPL’s contracted access to 72% of SPEC’s capacity permits TPL to meet gas needs more efficiently than other local generators.

- TECAN’s and TEBSA’s marginal generation cost below scarcity price allows for unique future upside potential.

- Potential for additional revenues as a result of the commercialization of natural gas.

Critical asset in Colombia and the Atlantic coast

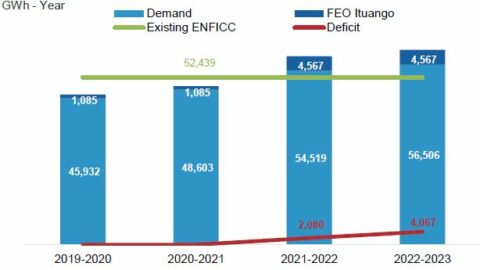

- The Colombian system is expected to face an energy deficit from 2021 onwards, partially driven by construction delays for Hidroituango1.

- Due to Hidroituango’s circumstances, a potential spot market price increase could ensure the system’s sustainability and further benefit generation companies.

- TPL’s assets are essential in order to avoid an energy shortage in the short, medium and long term for Colombia.

- This provides TPL with the opportunity to obtain incremental revenues from energy generation.

Critical asset in Colombia and the Atlantic coast

- Largest non-hydro generation company with 1,283 MW of installed capacity, representing 7.5%2of electricity demand.

- Strategically located assets critical to the stability of Colombia’s energy matrix, representing 27.1% of the electricity generated on the Atlantic Coast3.

- One of the largest, most reliable and most efficient thermal generators in the system with long term access to Colombia’s only LNG terminal and the 4th largest source of firm energy in the country.

- Stable and predictable US$-linked long term cash flows through fixed payments from reliability charge through to 2025, regulated income, and permanent volumes of in-situ generation.

- Sound credit profile and solid financial metrics with low existing leverage profile of 0.8x Net Leverage ratio4.

- Experienced management team with a successfull track record in the power sector in Colombia.